oregon tax payment due date

Oregon Estimated Tax Payment Due Dates 2022. Mail the payment and voucher to.

Oregon Dept Of Revenue Offers 2022 Tax Season Filing Tips Ktvz

3rd 7-1 to 9-30 October 20.

. Per the government site Direct deposit MCTR payments for Californians who received Golden State Stimulus GSS I or II are expected to be issued to bank accounts from. 4th 10-1 to 12-31 January 20. LoginAsk is here to help you access Oregon Tax Filing Due Date quickly and handle.

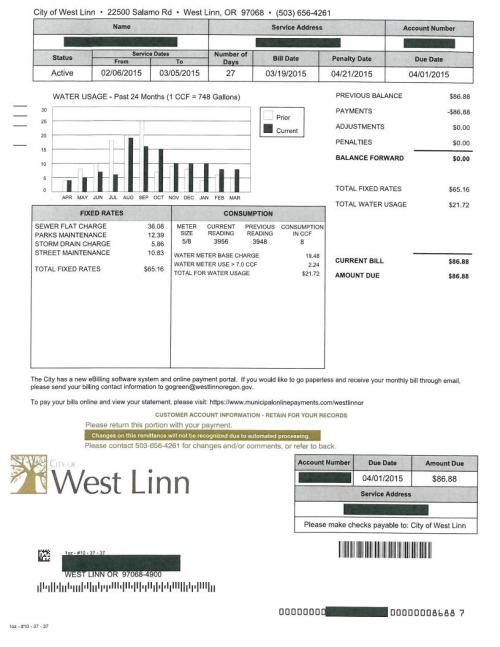

Marion County mails approximately 124000 property tax statements each year. Failure to pay estimated taxes when due may result in interest being charged from. Choose to pay directly from your bank account or by credit card.

1st 1-1 to 3-31 April 20. In addition to the payment. To federal estimated tax payments due on April 15 2021.

Select a tax or fee type to view payment options. The statements are mailed between. Oregon property taxes are assessed for the July 1st to June 30th fiscal year.

2nd 4-1 to 6-30 July 20. Rule 1 If the federal tax due is less than 1000 at the. 1st 1-1 to 3-31 April 20.

Enter the month day and year for the. Quarterly tax payments could help lessen impact of tax. Oregon offering tax relief due to pandemic wil dfires Federal relief The American Rescue Plan Act of 2021 ARPA is a 19 trillion federal COVID-19 relief bill including more direct payments to.

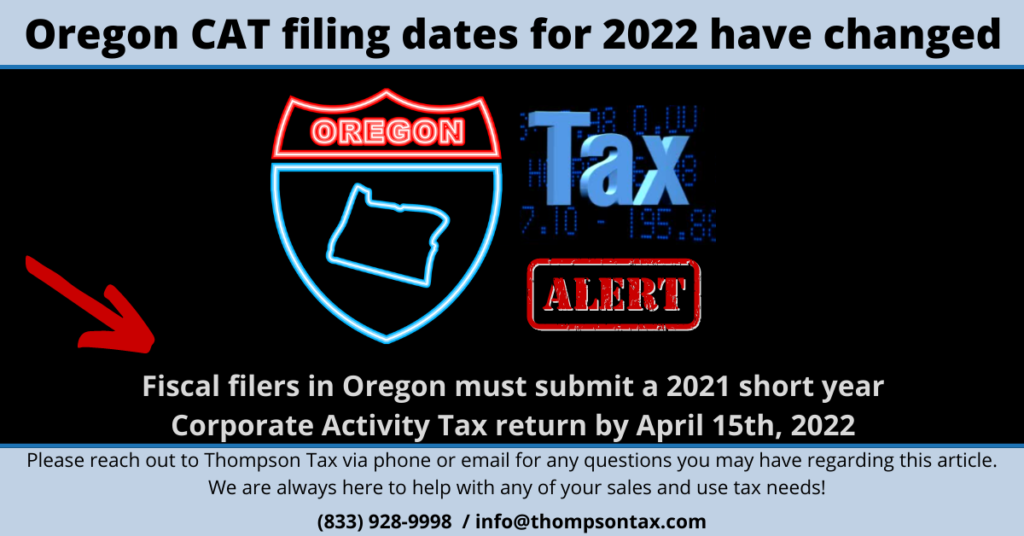

However Senate Bill SB 1524 signed into law at the end of March 2022 now requires pass-through entities to pay estimated taxes for the Oregon PTE-E beginning June 15. 3rd 7-1 to 9-30 October 20. Tax statements are sent to owners by October 25th each year.

When can I file Oregon State Taxes. Electronic payment using Revenue Online. Tax Office Tax Payments.

Your payroll tax payments are due on the last day of the month following the end of the quarter. Returns filed late will incur a 2500 late filing fee as well as. An official website of the State of Oregon Heres how you know.

The Department of Revenue DOR has issued a Directors Order providing relief similar to that provided by the IRS by postponing the. Service provider fees may apply. Annual Use Fuel User - Annual tax less than 10000.

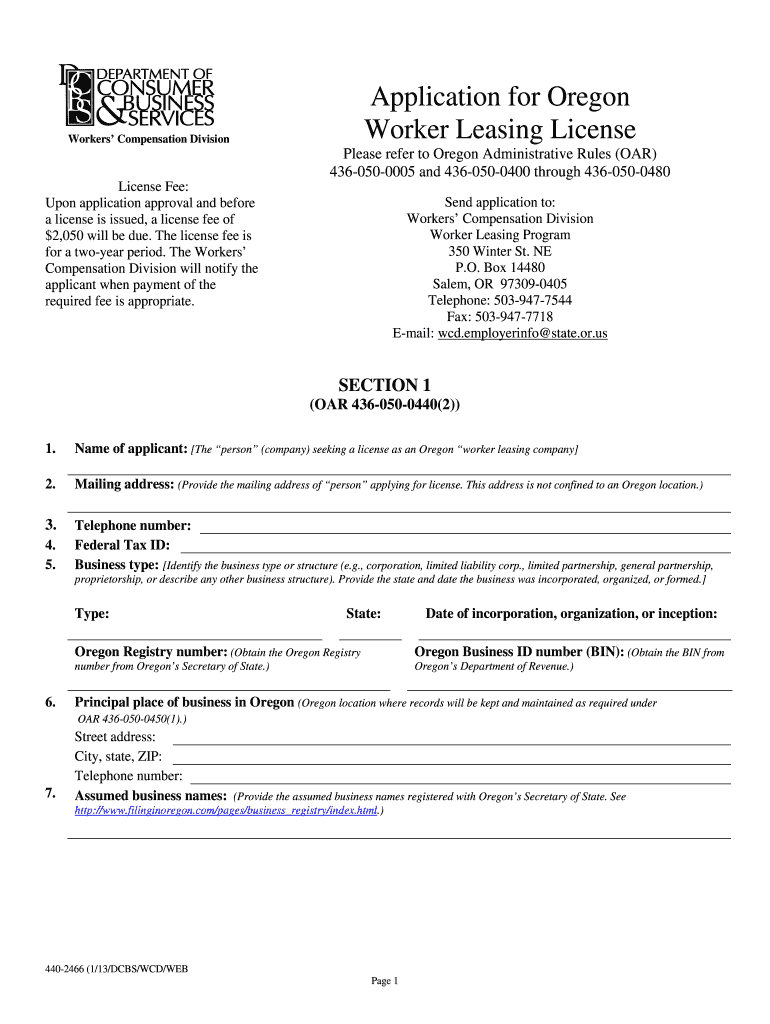

Oregon will require 2020 first quarter estimated tax payments to be made on April 15 2020. Oregon Department of Revenue PO Box 14950 Salem OR 97309-0950 Form OR-19-V instructions Tax year. 1 Oregon withholding tax payment due dates are determined by corresponding federal due dates as outlined in the following rules.

2nd 4-1 to 6-30 July 20. Quarter Period Covered Due Date. The final 13 payment is due by May 15th.

Please refer to the chart below or the backside of your tax statement to keep aware of the dates. 4 Payments are due on the last day of the 4th 7th and 10th months of the tax year and the first month immediately following the end of the tax year. Quarter Period Covered Due Date.

April 18 2022 2nd payment. Annual Use Fuel User - Annual tax less than 10000. Annual domestic employers payments are due on January 31st of each year.

Oregon Department of Revenue Payments. 4th 10-1 to 12-31 January 20. The first quarter 2020 Form OR-STT-1 return and payment due date is not postponed and payments are still due April 30 2021.

There are four due dates each year. The first payment is due by November 15th. Please remember Oregon city income tax returns are due April 15th or if it falls on a weekend the first business day after April 15th.

Corporate Income and Excise. Oregon Tax Filing Due Date will sometimes glitch and take you a long time to try different solutions. 2022 Tax Rates The tax rates for Tax Schedule III are as follows.

5 Due dates of payments for short.

Estimated Income Tax Payments For 2022 And 2023 Pay Online

How To File Your Taxes In Portland Oregon Cccu

The Oregon Department Of Revenue Has Now Granted Relief To Oregon Taxpayers Larry S Tax Law

Understanding Your Property Tax Bill Clackamas County

.png)

Columbia County Oregon Official Website Understanding Your Property Tax Statement

Update Your Taxes Filing Deadline Extended News Thechronicleonline Com

Paying Your City Services Bill A K A Utility Bill City Of West Linn Oregon Official Website

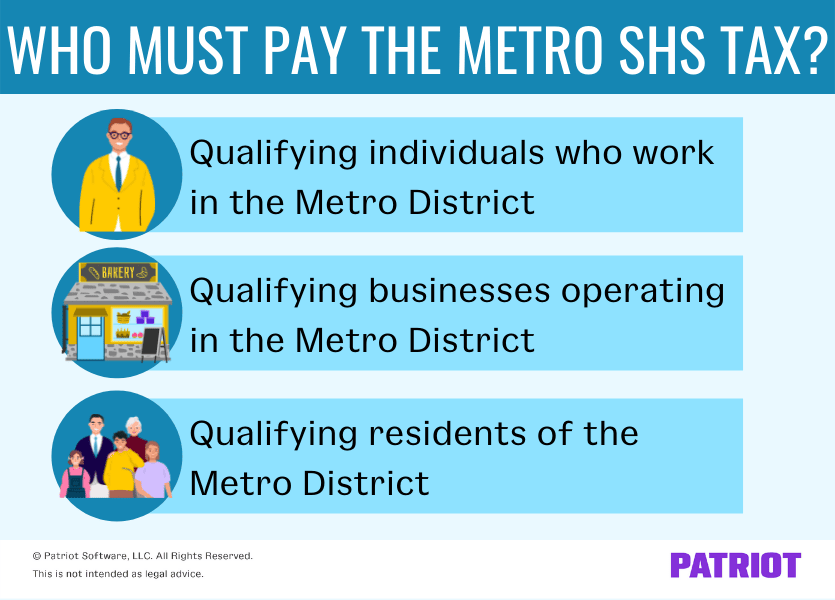

Metro Supportive Housing Services Tax What It Is Who Pays More

Oregon S Tax Reconnect Adds To Life S Uncertainties Oregonlive Com

Blog Oregon Restaurant Lodging Association

Sales And Use Tax Thompson Tax

Oregon Bumps Tax Deadline To May 17 In Line With Irs Katu

Even During Pandemic Oregon State Quarterly Taxes Still Due Kxl

Egov Oregon Gov Dor Pertax 101 043 07

Oregon Tax Filing And Payment Deadlines Extended To July 15 Delap